cap and trade vs carbon tax ontario

Canadas federal carbon tax increases on April 1. Simply put Premier Kathleen Wynne has imposed a new 19 billion annual tax on all Ontarians.

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

The introduction of the Proposed Act the challenges to the federal carbon tax and other recent developments in the Province of Ontario including decisions to wind down 758 renewable energy contracts and the various green programs funded by the cap and trade system have increased the level of uncertainty facing cleantech companies and other companies doing.

. For businesses Effective July 3 2018 we cancelled the cap and trade regulation and prohibited all trading of emission allowances. Under the federal governments carbon tax favoured by the PCs Ottawa has said provinces must choose between cap and trade and a carbon tax. The advantage of a carbon tax compared with cap and trade is that it is relatively easy to administer and straightforward to understand.

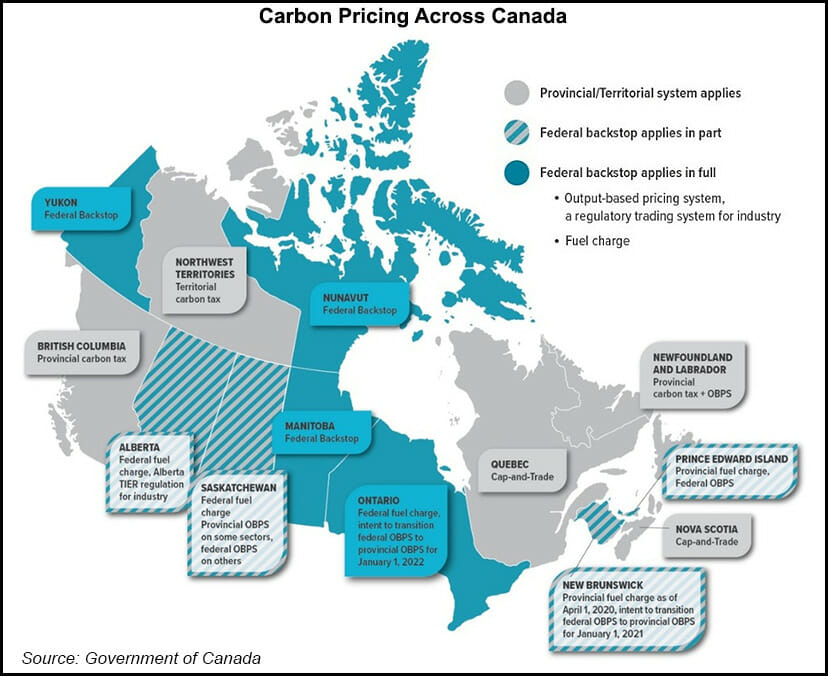

Most of the rest of Canada either already has a carbon pricing plan or will have one. It comes into effect on January 1 2018. The province made close to 3 billion in a series of cap-and-trade auctions since the system was introduced by the Liberals last year.

A carbon tax and cap-and-trade system complement each other ensuring there is a price on CO2 emissions across the entire economy given that a cap-and-trade system typically covers large stationary sources of emission at the production end while a carbon tax addresses the consumption end. Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways. The cap and trade program is a central part of Ontarios solution to fight climate change.

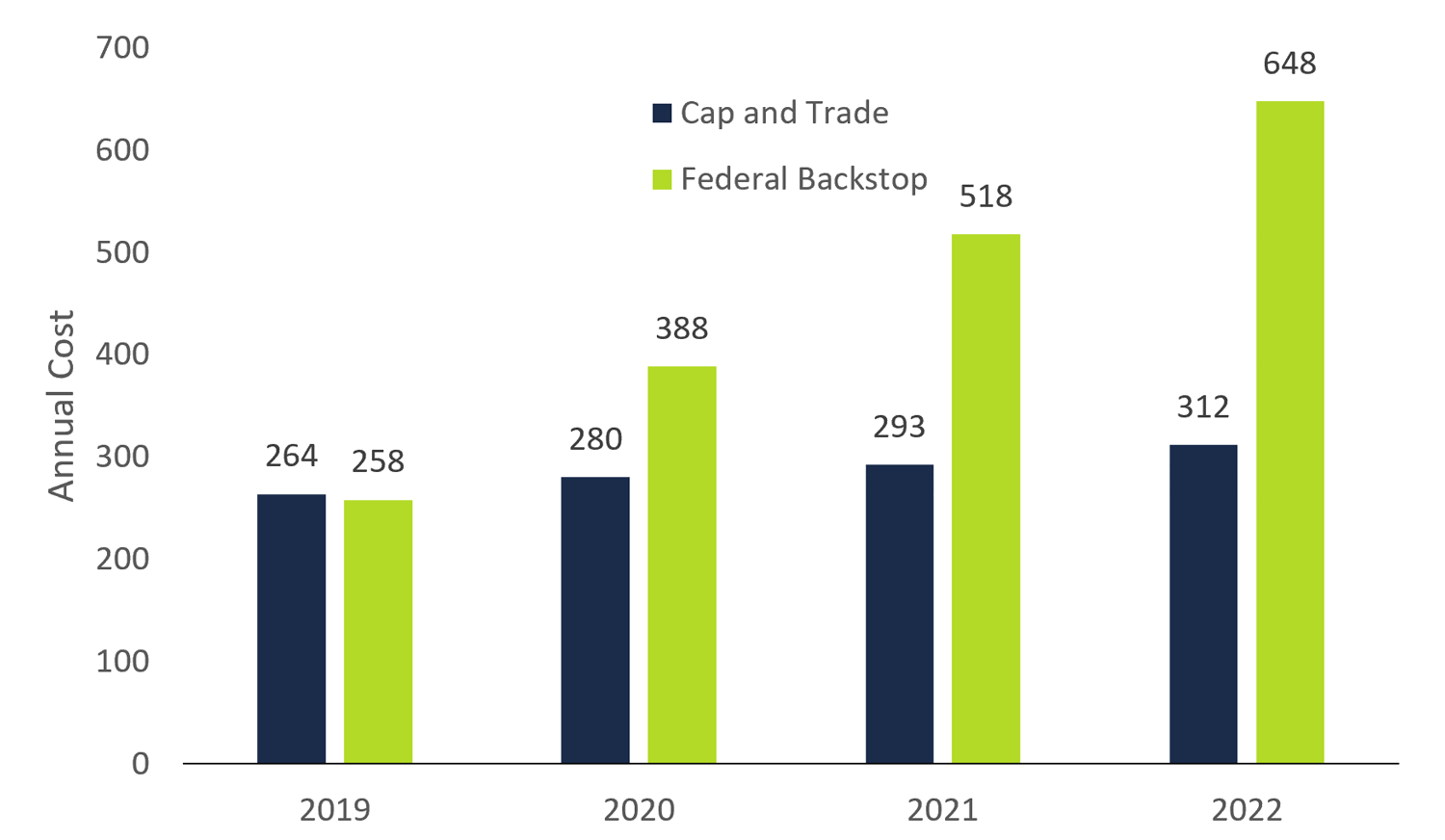

Each approach has its vocal supporters. Ontarios fiscal watchdog recently said the cancellation of. A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives.

The second is cap and trade which sets the maximum quantity. Before the policy the intersection of the supply and demand curves for. Linking the carbon market means that.

Both measures are attempts to reduce environmental damage without causing undue economic hardship to the industry. Whats important is that the price on carbon pollution provides an incentive for everyone from industry to households to be part of the. The only difference is cap and trade.

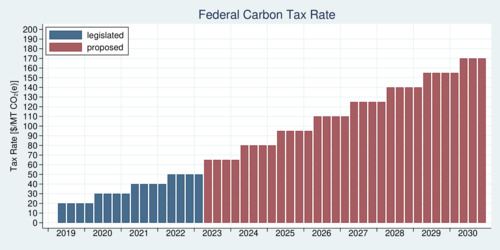

Proponents of cap and trade argue that it is a palatable alternative to a carbon tax. This will rise to 66 cents in 2020 88 cents in 2021 and 111 cents per litre in April 2022. The orderly wind down of the cap-and-trade carbon tax is a key step towards fulfilling the governments commitment to reducing gas prices by 10 cents per litre.

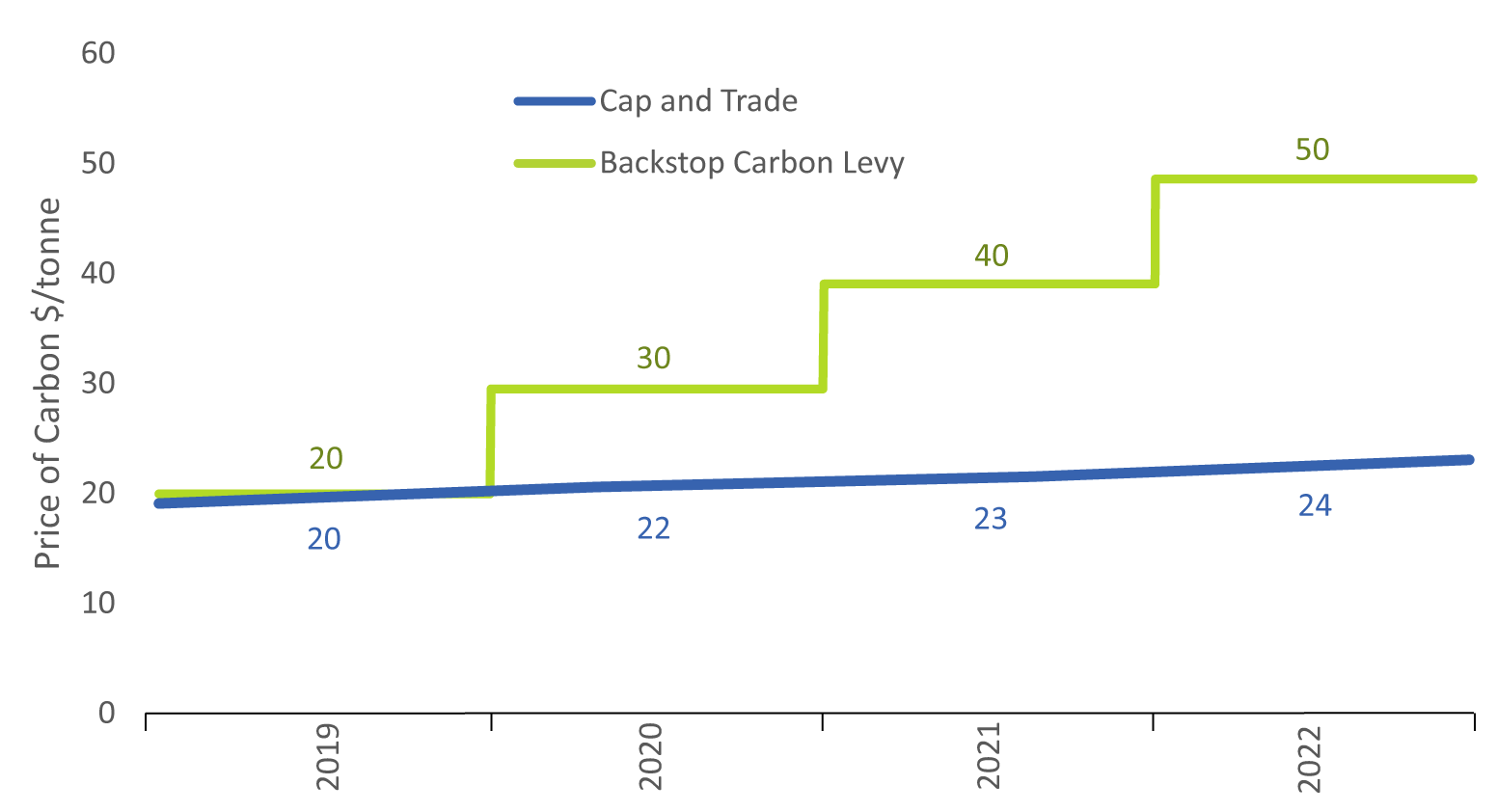

Under the federal governments carbon tax favoured by the PCs Ottawa has said provinces must choose between cap and trade and a carbon tax the price would be 50 a tonne by 2022. Under either a carbon tax or a cap-and-trade program the desired result is a level of CO2 abatement which equates the cost of abatement with the estimated benefits of. We have developed a plan to wind down the program.

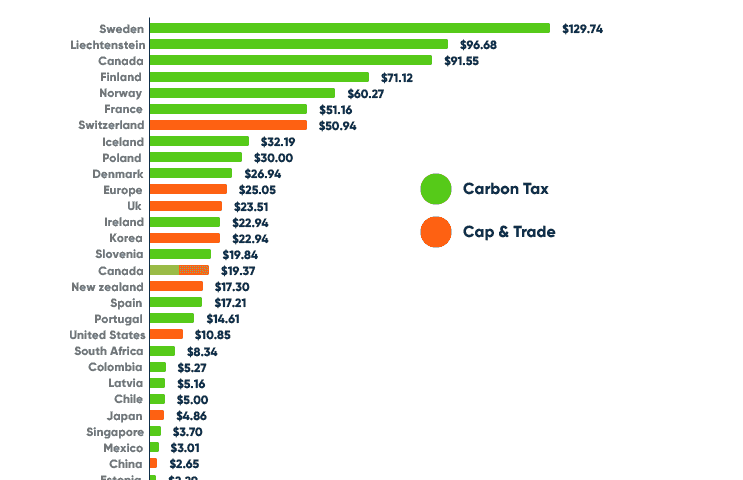

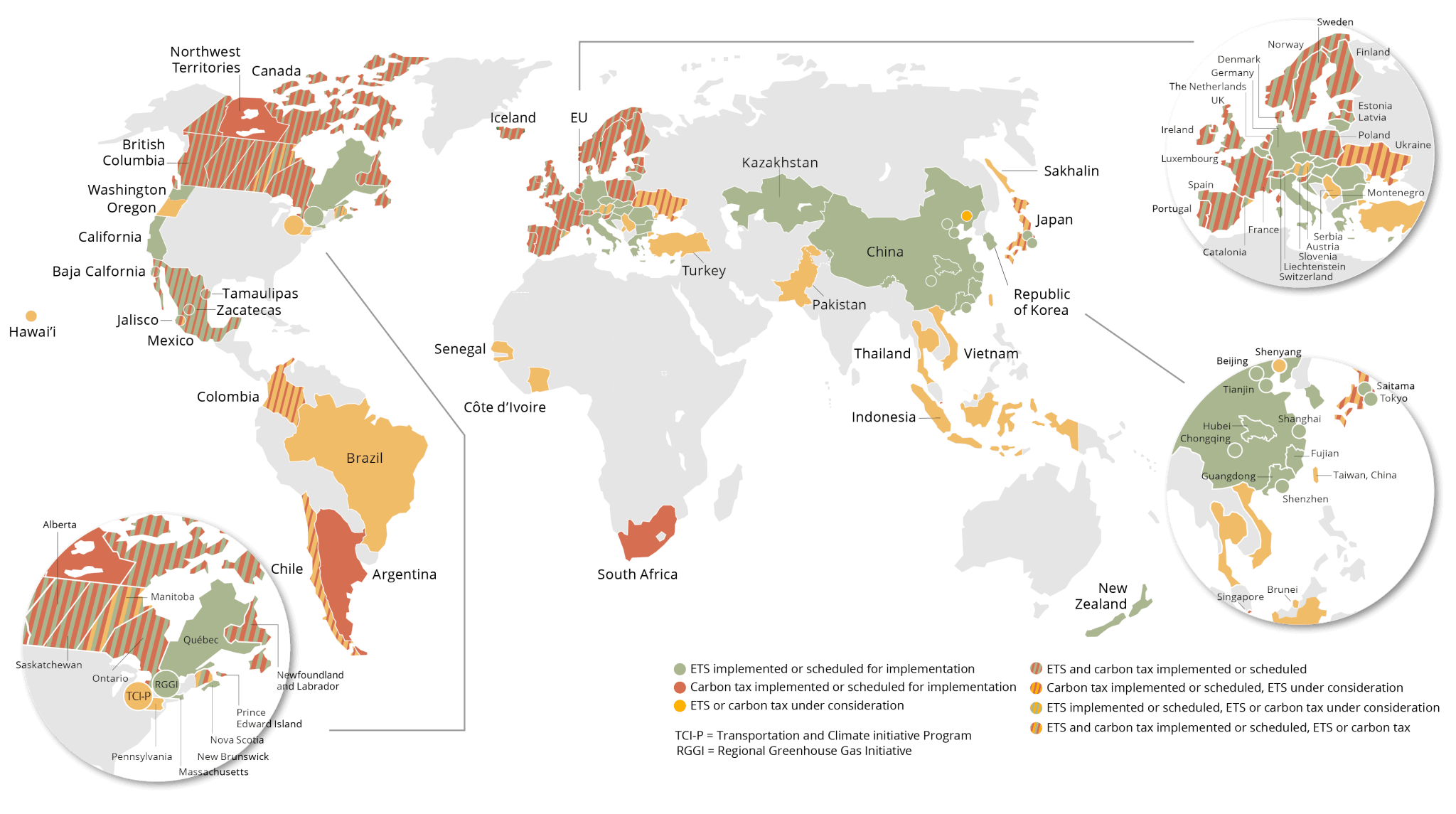

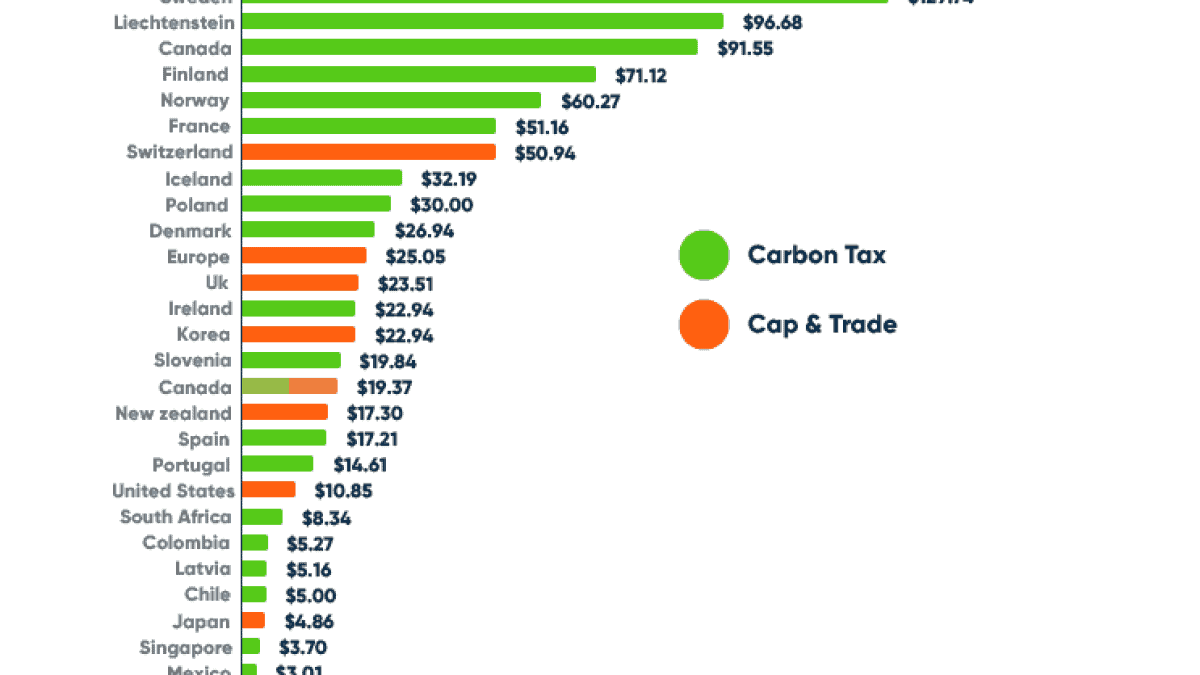

Peter MacdiarmidGetty Images G r. Australia and New Zealand carbon tax programs in various European and Scandinavian countries a carbon tax introduced in the Canadian province of British Columbia the cap-and-trade program to reduce greenhouse gas emissions by the nations involved in the European Unions Emissions Trading Scheme a pilot cap-and-trade scheme in seven cities in. To a first approximation cap-and trade is the equivalent of a carbon tax.

Or use a cap-and-trade system that achieves the same result. We signed a cap and trade linking agreement with Quebec and California on September 22 2017. Ontario unveils cap-and-trade plans as provinces take.

Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. Based on the Law 72021 the imposition of carbon tax will be carried out by focusing on two specific schemes ie the carbon tax scheme cap and tax and the carbon trade scheme cap. The David Suzuki Foundation believes this price should be applied broadly in the Canadian economy but that it can be done either through a carbon tax a cap-and-trade system or a combination of the two.

The federal carbon tax will increase the price of natural gas in Ontario by 39 cents per cubic metre. If a province has no plan or if its below the standard the federal. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs and is.

The first is a carbon tax which sets a price on carbon directly and lets individuals and companies decide how much carbon to produce. With the passage of Bill 4 The Cap and Trade Cancellation Act the Cap and Trade Cancellation Act on October 31 2018 the Government of Ontario formally repealed the Ontario cap and trade regime 1 and brought Ontarians and Ontario businesses into the federal. We will hold joint auctions of allowances with Quebec and California.

Thats because cap and trade is a carbon tax by another name. This is the federal law Progressive Conservative Leader Patrick Brown said in. In addition to saving families money the elimination of the cap-and-trade carbon tax will remove a cost burden from Ontario businesses allowing them to grow create jobs and compete around the world.

As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. Prime Minister Justin Trudeau announced a new nation-wide 10 per tonne carbon tax that will start in 2018 -- a price that will rise by 10 per year topping out at 50 by 2022. It will increase the price of gasoline in Ontario by 44 cents per litre.

Here is the Econ 101 version of how the two work. Allowances and credits issued by us Quebec and California will now be accepted by any of the three cap. Learn more about the program and what it means for you and the environment.

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. Under the federal governments carbon tax favoured by the PCs Ottawa has said provinces must choose between cap and trade and a carbon tax. In 2017 Ontario will introduce a cap-and-trade system.

Cap And Trade Formally Cancelled In Ontario Federal Carbon Pricing Regime Clarified. The Ontario cap-and-trade system aims to reduce emissions by 15 per cent of 1990 levels by the end of 2020 and reduce emissions by 37 per cent of 1990 levels by 2030.

Image Result For Carbon Price Climates World Economic Forum Business Practices

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Canada S Carbon Pricing Is Continuing On The Right Track

All The World S Carbon Pricing Systems In One Animated Map Sightline Institute

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

Economist S View Carbon Taxes Vs Cap And Trade

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Ontario S Getting Out Of The Carbon Tax Business Doug Ford Says But What S Next Cbc News Cap And Trade Toronto City Ford

Carbon Pricing Is Here To Stay In Canada What Is It Anyway Youtube

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Cap And Trade Basics Center For Climate And Energy Solutions

Carbon Markets Putting A Price On Carbon Green City Times

Cap And Trade Ambition Renewed In 2019 After A Decade Of Decline